Investors

In 2023, AP Trade Group entered the securities market. The issuer was East Logistics Systems LLC

17 years

Continuous development of ILS LLC

FMCG

Promising and stable market

RUB+ Rating

Stable outlook

Expert Rating Agency ra

Nestlé

Member of the G5 distributors of Nestlé Russia

43%

of AP Trade Group's turnover

Pavel Brezdenyuk, Director of Economics and Finance, AP-Trade Group

Over the first year since the bond issuance, AP-Trade Group has achieved breakthrough changes despite the unstable economic situation in the country. Changes have affected both the existing distribution business—with revenue growth driven by shipments to new territories in the European part of Russia (+19% in the first half of 2024), and new ventures. This year, AP-Trade Group became a franchisee of the Burger King restaurant chain with plans to open 17 restaurants across the Russian Far East. At the same time, the company has managed to contain its debt burden—the Debt/EBITDA ratio stood at 3.97 in September 2024—and to manage interest rate risks, with 94% of the group's loan portfolio covered by hedging agreements. In just 9 months of 2024, the group received 62 million rubles in compensation under current interest rate insurance agreements. The financial result of the issuer, OO ILS, for the first 9 months of 2024 exceeded the entire 2023 result by 2.5 times. The credit rating upgrade to RUB+ with a stable outlook indicates that the Expert RA rating agency highly values external risks of further increases in the Central Bank's key rate rather than the actions and performance of AP-Trade Group.

Key Indicators

Case fill rate (CFR)

95,9%

Delivery on time (DOT)

98,9%

2023

Revenue

36,5млрд ₽

DEBT

8,5млрд ₽

DEBT/EBITDA

3,7

2022

Revenue

34,4млрд ₽

DEBT

8,7млрд ₽

DEBT/EBITDA

3,6

2021

Revenue

34,4млрд ₽

DEBT

10,5млрд ₽

DEBT/EBITDA

5,2

Case fill rate (CFR)

94,7%

Delivery on time (DOT)

99%

2023

Revenue

15,4млрд ₽

DEBT

4,6млрд ₽

DEBT/EBITDA

4,5

2022

Revenue

14,8млрд ₽

DEBT

2,3млрд ₽

DEBT/EBITDA

4,6

2021

Revenue

12,8млрд ₽

DEBT

2,5млрд ₽

DEBT/EBITDA

6,2

Company History

1995

Company founded in Khabarovsk

1996

Branch opened in Yuzhno‑Sakhalinsk

1996

Contract signed with P&G

1997

Branch opened in Blagoveshchensk

1997

Branch opened in Komsomolsk‑on‑Amur

2001

Branch opened in Yakutsk

2001

Contract signed with Ruyan Group (UPECO since 2005)

2002

Branch established in Khabarovsk

2003

Branches opened in Vladivostok and Ussuriysk

2003

Branch opened in Nakhodka

.webp)

2003

Branch opened in Petropavlovsk‑Kamchatsky

2008

Branch opened in Dalnerechensk

.webp)

2008

Class A warehouse logistics complex launched in Khabarovsk

2009

Contract signed with Nestlé (distribution in Yuzhno‑Sakhalinsk)

2010

Contract signed with Nestlé (distribution in Petropavlovsk‑Kamchatsky)

2010

Sub‑distributor launched in Magadan

2011

First 3PL contract signed with Russian Otdykh

2011

Contract signed with Russian Otdykh company

2012

Class A+ warehouse logistics complex launched in Artyom

2012

NEXT project launched (independent transport services)

2012

Contract signed with Nestlé (distribution in Primorsky Krai)

2013

Contract signed with Nestlé (distribution throughout the Russian Far East)

2013

Logistics contracts signed with EFES, Samsung, Schneider Electric

2014

Product distribution project New Food launched

2014

Contract signed with Coca‑Cola

2015

Logistics contracts signed with BAT, Interlogistics, Business‑Trade

2015

Contract signed with Purina (distribution in Yakutia and Primorsky Krai)

2016

Contract signed with Jacobs (distribution in Khabarovsk, Blagoveshchensk, Komsomolsk‑on‑Amur, Kamchatka)

2016

Logistics contracts signed with KYB, Bridgestone, Nokian Tyres, Ayuss‑Logistics, Idemitsu

2017

Own online store launched

2017

Logistics contracts signed with JTI and Leroy Merlin

2018

Contract signed with Jacobs in Primorsky Krai and Yuzhno‑Sakhalinsk

2018

Class A warehouse logistics complex launched in Blagoveshchensk

2019

Distributor operations launched in Siberia: integration of DMS company

2019

First logistics service branch in Siberia opened (Irkutsk)

2020

Integration of P&G and 4C contracts in the Urals and Perm Krai

2020

Logistics contracts signed with MegaFon, Royal Canin, Baltika

2021

Integration of Nestlé contract in Irkutsk region, Transbaikal Krai, Buryatia

2021

Logistics contract signed with Yokohama

2022

Expansion of Jacobs distribution in the Republic of Sakha (Yakutia)

2022

Integration of PepsiCo contract in Krasnoyarsk Krai

2022

Logistics contracts signed with Chery and Philip Morris International

2022

Integration of Mondelēz contract in Sakha (Yakutia), Khabarovsk and Kamchatka Krais, Amur Oblast and Jewish Autonomous Oblast

2022

Integration of PepsiCo contract in Krasnoyarsk Krai

2023

Logistics contracts signed with M.Video and International Tobacco Group

2023

Integration of PepsiCo contract in Irkutsk and Ulan‑Ude

2023

AP TRADE Group strategy approved and management system transformed

2023

Launched new business directions:- • Residential quarter construction in Chita

- • E‑commerce

- • Tobacco line

- • Project “Okolo”

2023

AP TRADE became a public company: ILS LLC as part of AP TRADE Group issued debut bonds

2024

Continuation of business diversification and launch of new directions:- • Commercial building construction, commercial real estate leasing, creation of own management company, new contracts for residential complex construction

- • Mineral extraction

- • FMCG production

- • “Burger King” project

2024

New in 3PL: customs warehouse and cargo export from port

2025

New business direction launched: Bytype clothing brand

2024

Debut bond issuance on the Moscow Exchange

2023

Integration of PepsiCo contract in Kansk, Irkutsk and Ulan‑Ude

2023

Launched new business lines: construction, pet retail, e‑commerce, Stoloto lottery and tobacco sticks

1995

1996

1997

2001

2002

2003

2008

2009

2010

2011

2012

2013

2014

2015

2016

2017

2018

2019

2020

2021

2022

2023

2024

2025

Reports and Documentation

We trade popular brands.

The company's product portfolio includes brands with high FMCG market shares

80%

Shaving products market

47%

Baby Food Market

62%

Instant coffee market

45%

Feminine hygiene market

37%

Prepared breakfast market

39%

Laundry products market

57%

Chocolate Market

41%

Dishwashing products market

36%

Animal Feed Market

Rapidly developing as a logistics operator

NF Group

FIRST PLACE IN THE 2025 RANKING OF THE LARGEST LOGISTICS OPERATORS IN THE REGIONS OF RUSSIA

According to the results of the market analysis conducted by Knight Frank Russia, AP Trade was ranked among the largest logistics operators in terms of operated square meters.

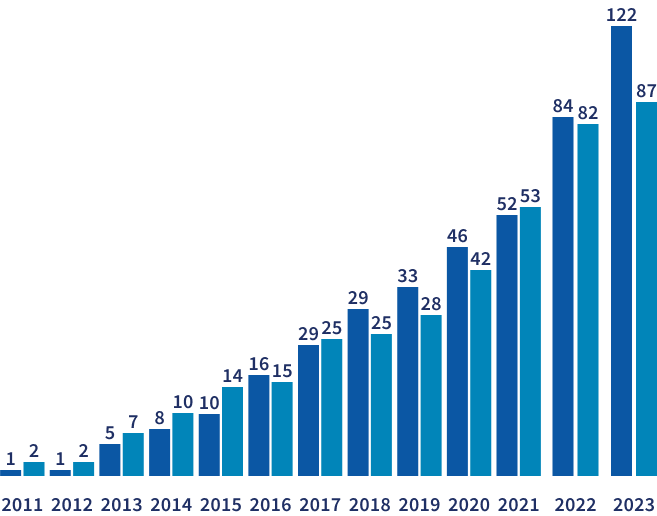

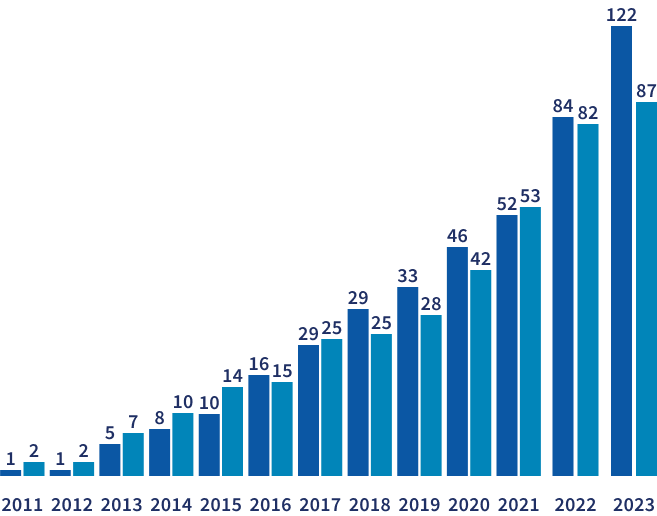

Number of customers

Storage, thousand m2

P&G

PG BEST PROJECT IN LOGISTICS 2024/2025

2019/2020

Number of customers

Storage, thousand m2

Well-known companies trust us with their goods

For responsible storage, processing and delivery

Mobil

American oil company, manufacturer of motor oils and lubricants

Yokohama

Japanese manufacturer of tires for passenger cars, trucks and special equipment

JTI

Japan Tobacco International - international tobacco company

Baltika

Russian manufacturer of brewing products and non-alcoholic beverages

Pepsi

American company, manufacturer of non-alcoholic beverages and food products

Chery

Chinese car manufacturer specializing in passenger cars

Lemana Pro

Company specializing in logistics and warehouse solutions

Lavr

Russian manufacturer of household chemicals and cleaning products

International Tobacco Group

International tobacco company with global presence

M.Video

Largest Russian chain of household appliances and electronics stores

CDEK

Russian company in the field of courier delivery and logistics services

Our Capacities

Our technologies meet the latest market requirements, and our warehousing complexes are up to international standards.

High-tech automated warehouses and cutting-edge IT solutions allow us to provide our clients with a full range of logistics services, continuously improving and adapting business processes to meet partner requirements

>220

freight vehicles

>50

tons/month

received at warehouses

>1 200

people in CSO

>180 000

total warehouse area

>90 000

LU warehouse area

>160 000

pallet spaces total warehouse capacity

High-tech automated warehouses and cutting-edge IT solutions allow us to provide our clients with a full range of logistics services, continuously improving and adapting business processes to meet partner requirements

Promising and Sustainable Market

FMCG-рынок остаётся более стабильным по сравнению с другими индустриями

Product groups

Dynamics (%) of sales in pieces

Dynamics (%) of sales in rubles

Foodstuffs

1,2

15,5

Household chemicals and personal hygiene

-4,5

10,5

Alcohol

4,2

11,5

Tobacco

-6,8

5,7

DIY

-14,5

9,2

Home appliances and electronics.

-11

3

Auto market

-53,5

-46

Clothing and Footwear

-25

-15

Consumer strategies

68%

Choose stores with low prices

49%

Look for items at reduced prices

62%

Buy only what they need, reducing costs

26%

Buy cheaper brands

7%

Buy more often, but in smaller quantities

Ambitious Development Strategy

AP Trade's goal until 2026 is to increase revenue by 2 times

Expand the scale of the business by

Development of areas

Merch, Promo, manufacturing and installation of advertising and merchandising equipment

Sales development in new channels, development of retail and E-commerce

Directed Development:

through mergers/acquisitions with smaller distributors

Scaling of existing contracts portfolio for the entire GC coverage area

Development of 3PL Services

2026

2-fold increase in net revenue

Focus on Profitability

Net Profit according to RAS

482 mln ₽

83,7 mln ₽

2021

734 mln ₽

84,7 mln ₽

2022

843,9 mln ₽

72,6 mln ₽

2023

AP Trade Group of Companies

LLC "IST Logistical Systems"

Own warehouses and fleet of vehicles

We have built 3 class A warehouses in the Far East

We own a total of 50 warehouses in the Far East and Siberia. Own fleet of 175 vehicles for sales representatives and 245 trucks for delivery.

Business Map

We efficiently operate across 8 time zones, supplying products to over 48,000 of our clients' stores. Our logistics cover 77% of Russia's territory, allowing us to serve 19% of the country's population.

32 000

stores

77%

the territory of Russia

8

time zones

19%

country's population

Contacts for investors

Pavel Borisovich Brezdenyuk

Director of Economics and Finance

Brezdenyuk_pb@aptrade.ru

8 (4212) 460-900